Being in “poor well being” is way over only a saying, in keeping with a brand new College of Michigan examine.

The truth is, adults’ danger of great monetary issues rises immediately with the variety of continual well being situations they’ve, the examine of practically 3 million privately insured adults finds.

They did not must have uncommon situations, both. The examine focuses on comparatively widespread long-term situations, together with hypertension, diabetes, melancholy, most cancers, dementia, stroke, substance use issues and customary illnesses of the center, lungs, kidneys and liver.

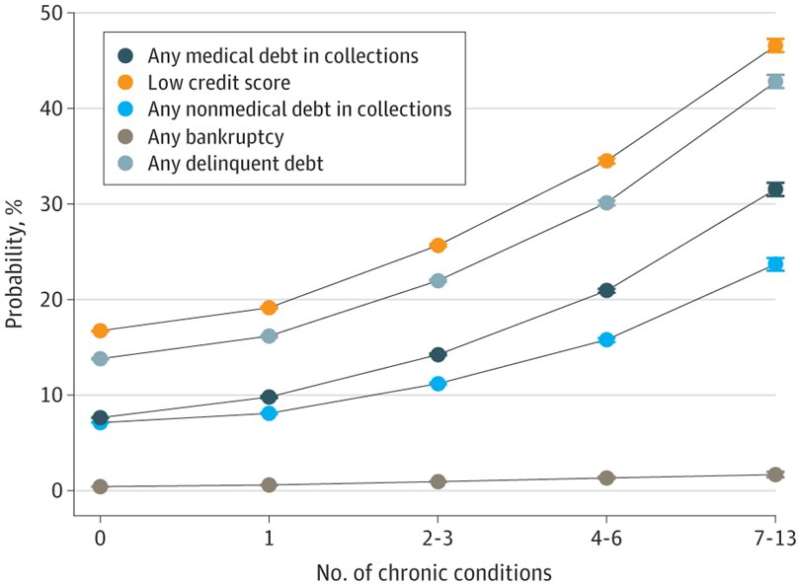

The extra of those situations somebody had, the upper their odds of being late on credit score funds, having poor credit score scores, having a group company become involved in money owed from unpaid medical or different payments, or going via chapter.

In all, individuals who had seven or extra of those situations had three to 4 instances the danger of every of those monetary calamities, in contrast with those that had no continual situations, in keeping with the findings printed in JAMA Inner Drugs.

And for the ten% of people that had medical money owed in collections, the examine reveals which situations have been linked with the best money owed. Stroke, critical psychological sickness corresponding to schizophrenia, and substance use issues topped the chart.

Nora Becker, M.D., Ph.D., and colleagues from the U-M Institute for Healthcare Coverage and Innovation used medical insurance claims knowledge from Michigan residents over the age of 20 lined by personal medical insurance, linked to knowledge from the identical people’ monetary histories.

That is among the many first makes use of of this type of knowledge linkage to review the monetary well being of such a big group of individuals and situations.

“After controlling for age and gender, the charges of opposed monetary outcomes rose dramatically in a ‘dose-dependent’ manner, primarily based on somebody’s general continual illness burden,” Becker explains.

“These findings are according to survey knowledge on monetary misery related to particular situations, corresponding to numerous types of most cancers. However this claims-based method offers us an in depth measure of every individual’s general continual illness burden in a really massive group. To see such a robust relationship was very hanging.”

Becker, an inside medication doctor and well being economist, labored with IHPI director John Z. Ayanian, M.D., M.P.P. and others at IHPI on the evaluation of information obtained from Blue Cross Blue Protect of Michigan and the Experian credit score monitoring bureau. The information have been anonymized and securely accessed by way of the Michigan Worth Collaborative to make sure that not one of the sufferers included within the examine could possibly be recognized.

The present paper focuses on a snapshot in time of every individual’s monetary state of affairs in January 2021, and diagnoses primarily based on an evaluation of their insurance coverage claims from the 2 earlier years. Becker and colleagues at the moment are working to investigate extra credit-reporting durations and medical populations.

The big pattern dimension signifies that it is attainable to see results even for smaller teams of individuals with numerous continual situations—such because the 5.4% who had 4 to 6 of the situations, and even the 1% who had seven to 13 of them.

It additionally allowed the examine group to see the outsized medical debt in collections among the many 0.3% who had critical psychological sickness, the 1% who had had a stroke, and the two% who had a substance use dysfunction.

Three-quarters of these within the examine have been age 20 to 64, and people over age 65 both had employer-based protection or a Medigap plan, however not a Medicare Benefit PPO. The examine didn’t embrace individuals lined by Medicaid, however different work by IHPI member and U-M Ross Faculty of Enterprise researcher Sarah Miller, Ph.D., has checked out their monetary well being.

Becker notes that the info used for the brand new examine cannot present the researchers which got here first, the well being situations or the poor monetary outcomes, or how they intertwined over time.

However on this pattern of primarily working-age employed adults, she notes, “We all know that sure situations have excessive out-of-pocket prices, whereas different situations make it so that you’ve hassle working, lowering revenue and monetary well-being. We additionally know that a few of these situations are worsened or accelerated by not attending to your well being in your youthful years, or could solely be recognized throughout a medical disaster—and these can also be affected by an individual’s revenue and monetary state.”

The examine knowledge additionally do not present which of the people had high-deductible well being plans, during which the primary few thousand {dollars} of well being prices are paid by the person every year, apart from sure preventive companies. About half of all Individuals lined by an employer-based plan have excessive deductibles on their insurance coverage.

Nora V. Becker et al, Affiliation of Power Illness With Affected person Monetary Outcomes Amongst Commercially Insured Adults, JAMA Inner Drugs (2022). DOI: 10.1001/jamainternmed.2022.3687

Quotation:

As well being issues stack up, so do critical monetary woes, examine reveals (2022, September 20)

retrieved 20 September 2022

from https://medicalxpress.com/information/2022-09-health-problems-stack-financial-woes.html

This doc is topic to copyright. Other than any honest dealing for the aim of personal examine or analysis, no

half could also be reproduced with out the written permission. The content material is supplied for data functions solely.