When Congress did not renew advance Little one Tax Credit score (CTC) funds final 12 months, public well being specialists feared that the lack of this month-to-month federal pandemic reduction profit would push thousands and thousands of households and youngsters in America again into poverty and starvation.

Now, a brand new examine led by researchers at Boston College Faculty of Public Well being (BUSPH) and Boston Medical Heart (BMC) reveals that within the months after this coverage ended, there was a considerable improve within the proportion of U.S. households with youngsters that might not afford sufficient meals to eat in a seven-day interval—a state of affairs generally known as meals insufficiency.

Revealed within the journal JAMA Community Open, the examine discovered that meals insufficiency elevated by roughly 25% amongst households with youngsters from January 2022 to July 2022, after they stopped receiving month-to-month CTC funds on January 15, 2022. The month-to-month money advantages had been a cornerstone of the Biden administration’s American Rescue Plan, offering an estimated 92% of U.S. households as much as $3,000 per baby ages 6 to 17 and as much as $3,600 per baby beneath age 6 from July 2021 to December 2021, with half of the credit score quantity distributed as advance month-to-month funds.

The examine is the primary to measure the affect of the expired advantages on meals insufficiency amongst households, and it follows the researchers’ earlier examine in JAMA Community Open, which confirmed that the CTC growth decreased meals insufficiency by 26% in 2021, findings that President Biden cited throughout the White Home Convention on Starvation, Diet, and Well being in late September.

This improve in meals insufficiency is an pressing drawback, significantly amongst households with youngsters, as poor diet uniquely impacts the well being and well-being of rising youngsters, the researchers say.

“This vital improve in meals insufficiency amongst households with youngsters is especially regarding for baby well being fairness, as baby well being, growth, and academic outcomes are strongly linked to their household’s skill to afford sufficient meals,” says examine lead and corresponding writer Allison Bovell-Ammon, director of coverage and communications at Kids’s HealthWatch, headquartered at BMC. “Even temporary intervals of deprivation throughout childhood can have lasting impacts on a toddler.”

As Congress negotiates a year-end tax reduction bundle, the researchers urge lawmakers to cross a completely refundable and inclusive advance CTC that ensures that each one households with youngsters throughout the U.S. are in a position to afford sufficient meals to maintain their youngsters wholesome.

“The six brief months of those Little one Tax Credit score superior funds clearly made a giant distinction for American households, a everlasting growth could be a game-changer for decreasing baby poverty for good,” says examine senior writer Paul Shafer, assistant professor of well being legislation, coverage & administration at BUSPH. “There may be extra to do to guarantee that very low-income households truly get the month-to-month funds, prompting efforts like GetCTC.org, however a everlasting growth permits assets and consciousness to construct across the coverage in a approach that short-term fixes do not.”

For the examine, the researchers examined nationally consultant census knowledge on demographic traits, employment, social helps, and meals insufficiency amongst almost 600,000 family households, from July 2021 to July 2022 (the interval earlier than and after expiration of the CTC month-to-month funds).

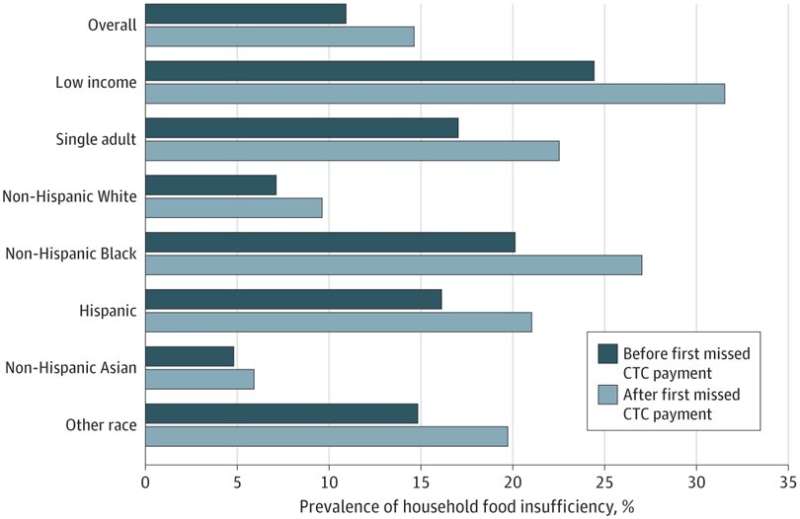

The findings additionally point out that the expiration of the CTC exacerbates racial and financial inequities in constant entry to sufficient and wholesome meals. The examine confirmed that low-income households skilled the best will increase in meals insufficiency after the advance funds led to January—significantly within the spring, after many households doubtless depleted the second half of their CTC credit issued in a lump sum fee after tax filings. The evaluation confirmed that single-adult, non-Hispanic Black, and Hispanic households—teams that traditionally have confronted higher hardships round meals entry—additionally skilled higher meals insufficiency after shedding their advance CTC funds.

“Black, Latino, Indigenous, and immigrant households within the US constantly expertise meals insecurity—a broader measure that assesses amount, high quality, and number of meals —at larger charges than White households because of present and historic marginalization and systemic racism,” Bovell-Ammon says.

The expanded CTC in 2021 decreased racial inequities by making certain entry to the credit score for predominantly Black, Latino, and Indigenous youngsters who had been beforehand excluded from the total advantages of the CTC, she says.

Immigrant households additionally skilled vital obstacles to CTC entry, says examine coauthor Stephanie Ettinger de Cuba, analysis affiliate professor of well being legislation, coverage & administration at BUSPH and government director of Kids’s HealthWatch. “These obstacles had been due partly to particular eligibility exclusions, however in addition they occurred even when immigrant households had been eligible. Following the expiration of the funds on the finish of 2021, the positive aspects in racial fairness had been eroded, probably additional exacerbating racial and well being inequities and rising mistrust.”

Allison Bovell-Ammon et al, Affiliation of the Expiration of Little one Tax Credit score Advance Funds With Meals Insufficiency in US Households, JAMA Community Open (2022). DOI: 10.1001/jamanetworkopen.2022.34438

Quotation:

US meals insufficiency spiked by 25% after month-to-month baby tax credit expired (2022, October 24)

retrieved 24 October 2022

from https://medicalxpress.com/information/2022-10-food-insufficiency-spiked-monthly-child.html

This doc is topic to copyright. Aside from any truthful dealing for the aim of personal examine or analysis, no

half could also be reproduced with out the written permission. The content material is offered for info functions solely.